Maharashtra’s 2N: Nagpur & Nashik Driving the State’s Logistics & Warehousing Boom

07 Mar 2025 10:55:45

India’s logistics and warehousing industry has expanded rapidly, reaching 533.1 million sq. ft in 2024. According to the JLL report, Tier II-III cities account for 95 million sq. ft (18%) of this total. Maharashtra plays a key role in this growth, contributing at least 28 per cent of the overall stock. While Mumbai and Pune lead among Tier I cities, Nagpur and Nashik are emerging as vital logistics hubs. Their rise underscores the growing importance of smaller cities in reshaping India’s warehousing and distribution networks.

Structural reforms in the logistics sector, particularly in infrastructure, were long overdue in India. In this direction, the Modi government has facilitated rapid technology adoption and created synergies among government ministries as well as state governments in developing and implementing logistics projects. It seems like the results are already being witnessed as there has been rapid transformation of India’s logistics and warehousing sector. This is driven by government policies, infrastructure developments, technological advancements, and shifting consumer behavior. This major shift in the country’s logistics map has occurred as Tier II-III cities have emerged as vital hubs for distribution networks.

This expansion is fueled by rising e-commerce activity, regional economic growth, and increasing consumer aspirations. These cities benefit from lower land costs and growing purchasing power, making them attractive for warehousing investments. The adoption of a hub-and-spoke model, further strengthened by implementing the Goods and Services Tax, is accelerating warehousing expansion.

Maharashtra

Maharashtra's cities have played a significant role in India's total warehousing stock, contributing at least 28% to India's total warehousing stock, which has reached 533.1 million sq ft. Mumbai (76 million sq ft) and Pune (60.9 million sq ft) together account for a major share among Tier 1 cities. Meanwhile, emerging Tier II-III cities like Nagpur (12.9 million sq ft) and Nashik (1.5 million sq ft) contribute substantially, making up 14% and 2% of the approximately 100 million sq ft from Tier II-III cities nationwide. This highlights the rapid expansion of Maharashtra's Tier II-III cities in the warehousing sector.

Nagpur: A Strategic Warehousing Destination

Nagpur has emerged as a key logistics and warehousing hub, with a total stock of 12.9 million sq. ft, marking a threefold increase since 2017. Of this, 4.7 million sq. ft comprises Grade A spaces. The city's strategic central location, robust transport connectivity, and proximity to major industrial corridors make it a crucial contributor to India's warehousing sector. Nagpur alone accounts for 14% of the total warehousing stock in Tier II-III cities, highlighting its growing significance.

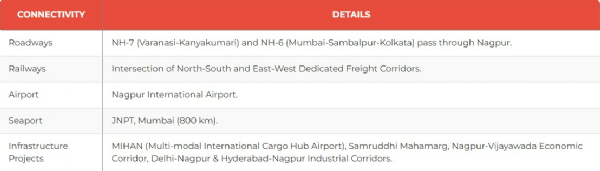

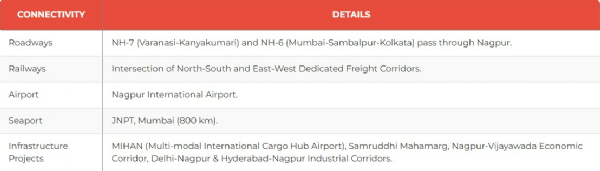

Strategic Location & Connectivity

Nagpur is uniquely positioned at the center of India, equidistant from major consumption hubs like Mumbai, NCR, Chennai, and Kolkata. Now, the Samruddhi Mahamarg has not only enhanced road connectivity but also extended the state’s logistical network into new regions, fostering economic growth, trade expansion, and improved logistics.

Major Industrial & Logistics Projects

ESR Nagpur 1 – 24 acres

ESR Nagpur 2 – 70 acres

XSIO Logistics Park by Blackstone – 45 acres

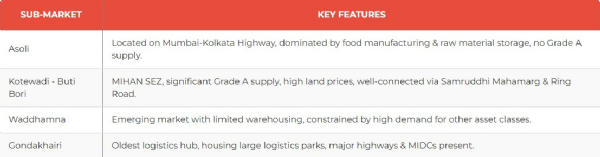

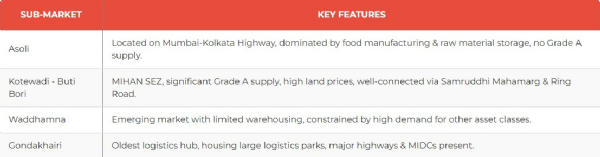

Industrial & Logistics Sub-Markets

Presence of Major Sectors & Key Occupiers

Nagpur’s rapid growth in the warehousing sector, backed by infrastructure development and strategic location, reinforces its importance in India's logistics ecosystem. As Tier II-III cities continue to expand their share, Nagpur stands out as a prime contributor, driving industrial and logistics advancements on a national scale.

Nashik: Growing Potential in Logistics Infrastructure

Nashik holds a strategic position as both an industrial and consumption hub, offering strong connectivity to key manufacturing centers and markets like Pune, Mumbai, Aurangabad, and Silvassa. With a warehousing stock of 1.5 million sq. ft—tripling since 2017, including 1.0 million sq. ft of Grade A spaces, the city is becoming a key player in Maharashtra’s warehousing sector. It is driven by the demand for efficient supply chains in manufacturing and retail sectors.

Strategic Location & Connectivity

Major Industrial & Logistics Projects

Ashoka Buildcon - 100 acres

Thakkar Developers - 400 acres

Bhatambrekar Developers - 23 acres

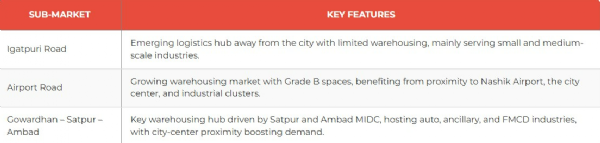

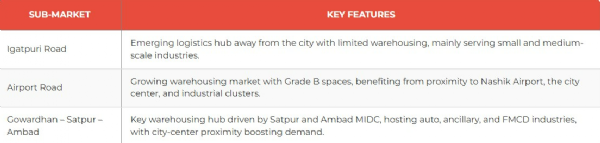

Industrial & Logistics Sub-Markets

Presence of Major Sectors & Key Occupiers

Government Initiatives

The warehousing sector in these cities is receiving a boost from various government initiatives, including:

Future Outlook

As Maharashtra continues to strengthen its logistics infrastructure, these cities are poised to play a crucial role in enabling seamless supply chains, driving regional economic growth, and supporting India’s ambition to become a $30 trillion economy by 2047.

Structural reforms in the logistics sector, particularly in infrastructure, were long overdue in India. In this direction, the Modi government has facilitated rapid technology adoption and created synergies among government ministries as well as state governments in developing and implementing logistics projects. It seems like the results are already being witnessed as there has been rapid transformation of India’s logistics and warehousing sector. This is driven by government policies, infrastructure developments, technological advancements, and shifting consumer behavior. This major shift in the country’s logistics map has occurred as Tier II-III cities have emerged as vital hubs for distribution networks.

This expansion is fueled by rising e-commerce activity, regional economic growth, and increasing consumer aspirations. These cities benefit from lower land costs and growing purchasing power, making them attractive for warehousing investments. The adoption of a hub-and-spoke model, further strengthened by implementing the Goods and Services Tax, is accelerating warehousing expansion.

Maharashtra

Maharashtra's cities have played a significant role in India's total warehousing stock, contributing at least 28% to India's total warehousing stock, which has reached 533.1 million sq ft. Mumbai (76 million sq ft) and Pune (60.9 million sq ft) together account for a major share among Tier 1 cities. Meanwhile, emerging Tier II-III cities like Nagpur (12.9 million sq ft) and Nashik (1.5 million sq ft) contribute substantially, making up 14% and 2% of the approximately 100 million sq ft from Tier II-III cities nationwide. This highlights the rapid expansion of Maharashtra's Tier II-III cities in the warehousing sector.

Nagpur: A Strategic Warehousing Destination

Nagpur has emerged as a key logistics and warehousing hub, with a total stock of 12.9 million sq. ft, marking a threefold increase since 2017. Of this, 4.7 million sq. ft comprises Grade A spaces. The city's strategic central location, robust transport connectivity, and proximity to major industrial corridors make it a crucial contributor to India's warehousing sector. Nagpur alone accounts for 14% of the total warehousing stock in Tier II-III cities, highlighting its growing significance.

Strategic Location & Connectivity

Nagpur is uniquely positioned at the center of India, equidistant from major consumption hubs like Mumbai, NCR, Chennai, and Kolkata. Now, the Samruddhi Mahamarg has not only enhanced road connectivity but also extended the state’s logistical network into new regions, fostering economic growth, trade expansion, and improved logistics.

Major Industrial & Logistics Projects

ESR Nagpur 1 – 24 acres

ESR Nagpur 2 – 70 acres

XSIO Logistics Park by Blackstone – 45 acres

Industrial & Logistics Sub-Markets

Presence of Major Sectors & Key Occupiers

Nagpur’s rapid growth in the warehousing sector, backed by infrastructure development and strategic location, reinforces its importance in India's logistics ecosystem. As Tier II-III cities continue to expand their share, Nagpur stands out as a prime contributor, driving industrial and logistics advancements on a national scale.

Nashik: Growing Potential in Logistics Infrastructure

Nashik holds a strategic position as both an industrial and consumption hub, offering strong connectivity to key manufacturing centers and markets like Pune, Mumbai, Aurangabad, and Silvassa. With a warehousing stock of 1.5 million sq. ft—tripling since 2017, including 1.0 million sq. ft of Grade A spaces, the city is becoming a key player in Maharashtra’s warehousing sector. It is driven by the demand for efficient supply chains in manufacturing and retail sectors.

Strategic Location & Connectivity

Major Industrial & Logistics Projects

Ashoka Buildcon - 100 acres

Thakkar Developers - 400 acres

Bhatambrekar Developers - 23 acres

Industrial & Logistics Sub-Markets

Presence of Major Sectors & Key Occupiers

Government Initiatives

The warehousing sector in these cities is receiving a boost from various government initiatives, including:

- Make in India & National Logistics Policy - Strengthening India’s logistics framework

- Maharashtra Logistics Policy 2024 - Includes an Integrated Logistics Master Plan, key hubs in Navi Mumbai-Pune and Nagpur-Wardha, and five state and regional logistics hubs to enhance connectivity and infrastructure.

- Production-Linked Incentives (PLI) & Design-Linked Incentives (DLI) - Encouraging manufacturing and supply chain efficiency.

- PM Gati Shakti, Bharatmala, Sagarmala, and UDAN schemes - Enhancing multimodal connectivity.

- Urban Infrastructure Development Fund - Allocating ₹10,000 crore annually for infrastructure development in Tier-2 and Tier-3 cities.

- Shift to Hub-and-Spoke Model - A structural transformation in India’s logistics sector, aligning warehousing expansion with the efficiencies envisioned under GST.

Future Outlook

As Maharashtra continues to strengthen its logistics infrastructure, these cities are poised to play a crucial role in enabling seamless supply chains, driving regional economic growth, and supporting India’s ambition to become a $30 trillion economy by 2047.