#SecurityScan 103: PM Modi's US Visit, F-35 vs SU-57 & much more

A potential defense pact could further solidify India’s position against China and address security concerns stemming from Pakistan-based terrorism.

Total Views |

This article is a summary of important events that have taken place in the last one week affecting India's national security.

Topics Covered

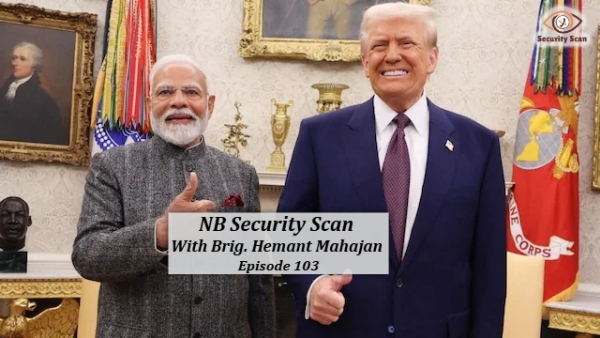

- PM Modi's US Visit: India’s Strategic Goals under Trump 2.0

- F-35 vs SU-57: Comparison of Fifth-Generation Fighters

- Tariffs, Technology, and Trade Wars: A Seismic Shift in US-China Relations

- Strengthening India-Indonesia Ties: Opportunities and Challenges

PM Modi's US Visit: India’s Strategic Goals under Trump 2.0

Navigating an Unpredictable Trump Administration

Prime Minister Narendra Modi’s visit to the United States highlights the complexities of bilateral relations under President Donald Trump’s often unpredictable leadership. India aims to address challenges in trade, defense, and energy while securing long-term benefits for India. Trump’s “Make America Great Again” (MAGA) agenda, driven by ultra-nationalism, anti-migrant rhetoric, and trade wars, creates a challenging backdrop.

Bridging the Trade Deficit: A Persistent Challenge

Trade relations remain a contentious issue, with Trump’s tariffs targeting several nations, including a looming threat to impose 100% tariffs on BRICS countries. Bilateral trade reached $118 billion in 2023-24, with India’s trade surplus climbing to $45.6 billion in 2024. Trump’s criticism of India’s high tariffs necessitates concessions.

To address these tensions, India has proposed tariff reductions on high-end American products like Harley Davidson motorbikes and Tesla cars. The 2025 Union Budget hints at further duty cuts to align with Trump’s demands. Additionally, India plans to increase imports of American defense equipment, crude oil, and liquefied natural gas (LNG) to reduce the trade deficit. A potential mini trade agreement could lower import taxes on American-made electronics, medical gear, and chemicals, while India pushes for fewer restrictions on exports of pharmaceuticals, IT services, and textiles. Safeguarding intellectual property rights and ensuring regulatory transparency remain key US demands.

Geopolitical Realities: Balancing Relations with Russia, China, and Iran

India’s strategic partnerships with Russia and its economic ties with China complicate its engagement with the US. Despite the threat of American sanctions under the Countering America’s Adversaries Through Sanctions Act (CAATSA), India continues to purchase Russian S-400 missile systems and discounted crude oil. Concurrently, India’s rivalry with China positions it as a critical partner for the US in countering Beijing’s dominance in the Indo-Pacific region. India’s involvement in the Quad alliance further strengthens this partnership.

India’s trade relations with Iran also present challenges. Iran serves as a key energy supplier and a strategic partner for connectivity initiatives like the Chabahar Port. Modi’s visit offers an opportunity to negotiate waivers or relaxed sanctions, enabling India to pursue energy and infrastructure projects in Iran. In return, the US may seek India’s stronger alignment on countering Iranian influence in the Middle East.

Strengthening Defence and Energy Cooperation

Defense cooperation has been a cornerstone of US-India relations. India’s acquisition of American military equipment, such as Seahawk helicopters and Predator drones, underscores the deepening defense ties. India’s plans to procure additional C-130 Hercules transport planes and P-8I maritime patrol aircraft highlight its commitment to bolstering its defense capabilities.

Energy cooperation is another critical area. India’s import of American LNG and crude oil has diversified its energy portfolio. Modi’s visit is expected to explore collaborations in nuclear energy and renewable energy projects, including solar and hydrogen. A potential defense pact could further solidify India’s position against China and address security concerns stemming from Pakistan-based terrorism.

Revitalizing the Civil Nuclear Partnership

Despite the historic 2008 US-India civil nuclear deal, progress has been limited due to concerns over India’s Civil Nuclear Liability Law and restrictions on Indian nuclear entities. Recent moves, such as removing the Bhabha Atomic Research Centre (BARC) from the US Entities List, signal a renewed commitment. Amending liability laws could pave the way for greater US participation in India’s nuclear energy expansion.

Immigration and Deportation: Navigating Sensitive Issues

Immigration policies and deportation practices have become significant irritants in US-India relations. The recent deportation of over 100 Indian citizens in a crude manner has caused outrage in India. Modi is expected to advocate for more respectful deportation procedures and enhanced opportunities for skilled Indian professionals and students through the H-1B visa program, which has significantly benefited Indian IT specialists.

A Pragmatic Approach to Bilateral Relations

Modi’s visit underscores the strategic importance of the US-India partnership in addressing shared geopolitical challenges. While Trump’s firm stance on trade and immigration poses hurdles, both nations recognize the mutual benefits of a strengthened relationship. By offering carefully considered concessions in trade, defense, and energy, Modi seeks to navigate Trump’s unpredictability and lay the groundwork for India’s long-term strategic interests.

F-35 vs SU-57: Comparison of Fifth-Generation Fighters

The recently concluded Aero India 2025 witnessed a significant face-off between the U.S. F-35 fighter jet and Russia's SU-57. While the SU-57 soared across the skies, the F-35 was displayed on the ground. Both nations have offered these fifth-generation fighters to India, but how do they compare? This article delves into their features, capabilities, and suitability for India’s defense needs.

The Contenders: F-35 and SU-57

Both the F-35, manufactured by U.S. defense giant Lockheed Martin, and the SU-57, developed by Russia’s Sukhoi, are fifth-generation fighters with advanced capabilities.

The F-35 is hailed as “the world’s most advanced multirole fighter jet” and boasts development collaboration from nine nations, including the U.S., U.K., and Australia. Each unit costs between $80 million and $115 million, making it a high-cost but high-performance aircraft.

The SU-57, Russia’s first advanced fighter since the Cold War, is marketed as an affordable alternative to the F-35. While Moscow has not disclosed exact costs, it claims the SU-57 is significantly cheaper. However, delays and production challenges have limited its deployment, with only 40 units manufactured since its maiden flight in 2010.

Technical Specifications: Under the Hood

Performance and Power

F-35: A single-engine aircraft equipped with the Pratt & Whitney F135 engine, it achieves a top speed of Mach 1.6. It has a range of 2,172 kilometers and a fuel capacity of 18,498 pounds, with a maximum altitude exceeding 50,000 feet.

SU-57: A twin-engine fighter powered by Russia’s Saturn AL-41F1 engines, it reaches a higher top speed of Mach 1.8 and a range of 2,999 kilometers. It also operates at altitudes up to 54,100 feet.

Avionics and Weaponry

F-35: Features cutting-edge systems like the Electro-Optical Distributed Aperture System (DAS) for missile and aircraft warnings, and the Electro-Optical Targeting System (EOTS) for long-range precision strikes. Pilots benefit from the world’s most advanced helmet-mounted display, providing complete mission data on the visor.

SU-57: Includes innovative features like a serrated exhaust nozzle for reduced radar signature and advanced onboard electronics, such as an AI “second pilot.” Its radar is integrated across the aircraft, while its internal weapons bays can carry up to 7.4 tons of armament, including air-to-air and air-to-ground missiles.

Global Adoption and Production Challenges

F-35: With over 1,000 units in service across multiple nations, the F-35 is widely regarded as a successful platform.

SU-57: Russia has faced development delays, with full-scale production beginning only in 2022. A crash in 2019 and concerns over its stealth capabilities have further hampered its reputation. To date, no confirmed international buyer has been announced for the SU-57.

Why Does India Need a Fifth-Generation Fighter?

India’s Air Force comprises 2,229 aircraft, including around 600 fighter jets, but lacks a fifth-generation platform. The current fleet includes fourth-generation jets like the Dassault Rafale, which fall short of matching the advanced capabilities of Chinese and Pakistani counterparts.

China has inducted over 200 J-20 stealth fighters and is working toward a fleet of 1,500 fifth- and sixth-generation jets by 2035. Pakistan has plans to acquire fifth-generation fighters from China and Turkey, further increasing the challenge for India in a potential two-front war scenario.

India’s indigenous fifth-generation program, the Advanced Medium Combat Aircraft (AMCA), is still under development and unlikely to enter service before 2036, leaving a critical gap in air power.

Expert Opinions: Pros and Cons

SU-57: Some experts dismiss the SU-57 as an inadequate option for countering China. Defense journalist Angad Singh called it “the least-capable fifth-generation fighter” with minimal utility against Chinese advancements.

F-35: While advanced, the F-35 has faced criticism for being cost-intensive. Zen Technologies’ chairman, Ashok Atluri, referred to it as a “white elephant” and advocated for India to focus on drones and anti-drone systems instead.

Recommendations

Both the F-35 and SU-57 have unique strengths and challenges. The F-35 offers unmatched technological capabilities and global reliability but comes at a steep price. Meanwhile, the SU-57 presents a more economical alternative but lags in production and global adoption. As India evaluates its options, it must carefully balance cost, capability, and geopolitical considerations to strengthen its air force in a rapidly evolving security landscape.

Tariffs, Technology, and Trade Wars:

A Seismic Shift in US-China Relations

The global trade war is intensifying. On January 20, Donald Trump was sworn in as the 47th President of the United States, marking a pivotal moment on the world’s largest political stage. This transition signals a shift in global power dynamics, with significant implications for South Asian politics as well.

Trump’s foreign policy can be understood through a mix of realist and neorealist principles, emphasizing nationalism, power balance, and bilateralism over multilateralism. Simultaneously, constructivist elements such as identity politics and populist rhetoric have also shaped his leadership style, particularly in the context of US-China relations.

The Thucydides Trap: A Battle for Global Supremacy

US-China relations are often analyzed through the lens of the “Thucydides Trap,” where an emerging power (China) challenges the dominance of an established hegemon (US). From a realist perspective, both nations are engaged in a zero-sum struggle for global supremacy, evident in their competition across technology, electric vehicles, global trade, and artificial intelligence.

Military tensions have also escalated in the Taiwan Strait and the South China Sea, reinforcing the ideological battle between liberal democracy and authoritarian state capitalism. While China is officially classified as a developing nation by the World Trade Organization (WTO), its economic performance surpasses that of many developed nations.

Since the interwar period, the US has been the world’s largest economy. With a Gross Domestic Product (GDP) of $29 trillion in 2024, it maintains this position, followed by China with a GDP of $18 trillion. However, in terms of Purchasing Power Parity (PPP), China leads with a PPP-adjusted GDP of $37.1 trillion, while the US follows with $29.2 trillion. This economic rise presents a major challenge to US dominance.

China’s Trade Surplus: A Growing Concern for the US

According to the Office of the United States Trade Representative (USTR), US-China trade in goods reached approximately $758.4 billion in 2022, with the US running a trade deficit of over $367.4 billion. In 2023, the US House of Representatives unanimously voted to challenge China’s status as a developing nation, reflecting growing anxiety over China’s increasing influence in global trade.

US imports from China have surged from $100 billion in 2001 to approximately $551 billion in 2024. China’s merchandise trade surplus now stands at nearly $980 billion. In November 2024, China’s exports to the US totaled $47.3 billion—an 8% increase from the previous month. Conversely, US exports to China declined by 15.9% to $13.5 billion. This trade imbalance reinforces US concerns about China’s economic practices and global supply chain dependencies.

Trump’s Tariff Diplomacy: Lessons from the First Term

In March 2018, under the Trade Expansion Act of 1962, the Trump administration imposed Section 232 tariffs, citing national security concerns. These tariffs placed a 25% duty on steel and a 10% duty on aluminum, aiming to reduce foreign dependency and boost domestic production. As a result, US steel production increased by 1.9% and aluminum production by 3.6% between 2018 and 2021.

China’s key industries, such as semiconductors, suffered a 72% decline in imports to the US. Overall, imports of products subject to Section 301 tariffs dropped from $311 billion in 2017 to $265 billion in 2021. In retaliation, China imposed tariffs targeting US agricultural exports, particularly soybeans, pork, and dairy, strategically affecting industries in key swing states. This forced the US government to provide billions in subsidies to American farmers.

The January 2020 Phase One trade agreement sought to de-escalate tensions, with China committing to purchase $200 billion in additional US goods over two years. However, China failed to fully meet these commitments, further straining bilateral relations.

Trump vs. China: A Renewed Trade War?

Trump frequently emphasizes tariffs as a key economic tool, and his potential second term could reignite trade hostilities. His administration has consistently viewed China’s ambitions—especially its influence in the Global South—as a direct challenge to US interests. Trump’s fluctuating stance on trade suggests that while negotiations remain possible, a renewed trade war is a likely scenario.

From a geopolitical perspective, tensions remain high. The US-China trade relationship, influenced by dependency theory, highlights global inequalities—developing nations are often trapped by Chinese loans under the Belt and Road Initiative (BRI) or marginalized in US-led trade blocs. Taiwan remains a flashpoint, with the US seeing it as a crucial ally in the Indo-Pacific, while China considers it a core national issue. Arms sales and military exercises further exacerbate tensions.

China’s Response: AI, Rare Earths, and Economic Resilience

In response to US pressure, China is leveraging its dominance in artificial intelligence, rare-earth mineral production, and its vast economic scale. Beijing has announced its AI chatbot “Deep Seek,” positioning itself as a formidable competitor to US AI firms. Trump has already responded by proposing tariffs on foreign production of chips, semiconductors, aluminum, steel, copper, and pharmaceuticals.

China’s growing role in global institutions, such as the United Nations (UN) and World Health Organization (WHO), also alarms Western policymakers. To counter China’s influence, the US has promoted initiatives like the Blue Dot Network, designed to challenge the BRI’s economic dependencies.

Trump 2.0: The Future of US-China Relations

Trump’s first presidency rejected multilateralism, and a potential second term could see a continuation of his populist and nationalist policies. China’s growing influence in Latin America, particularly in Panama—a historical US sphere of influence—has also raised concerns. Panama’s diplomatic switch from Taiwan to Beijing in 2017 underscores China’s expanding geopolitical reach, including its strategic investments in the Panama Canal.

The rivalry between the US and China is no longer limited to trade and tariffs—it extends to commanding the modern economy, artificial intelligence, electric vehicles, and strategic supply chains. Trump’s aggressive tariff strategy may provoke strong countermeasures from Beijing, further escalating economic and political hostilities.

A Multipolar Future? The Stakes for Global Governance

The US-China relationship under Trump 2.0 is set to shape the global order for years to come. This conflict transcends trade deficits and tariffs—it is a contest for dominance in the 21st-century economy. With China’s GDP at $18 trillion and its trade surplus nearing $980 billion, the US must navigate a delicate balance between economic containment and strategic competition.

While the US counters China through initiatives like the Blue Dot Network, China continues to expand its influence through the Belt and Road Initiative. The question remains: will these moves consolidate American supremacy, or will they accelerate the transition to a multipolar world order?

The stakes could not be higher for the international community, as US-China policies will have far-reaching implications for allies, adversaries, and emerging economies alike.

Strengthening India-Indonesia Ties:

Opportunities and Challenges

A Historic Milestone in Bilateral Relations

Indonesia is India’s largest trading partner within ASEAN, and bilateral ties are set to deepen further. The visit of Indonesian President Prabowo Subianto as the chief guest for Republic Day is a significant event. This marks the fourth time an Indonesian President has received this honor, underscoring the strategic importance of the India-Indonesia partnership. Expectations are high for this visit, given the robust trade, investment, and cultural ties between the two nations.

A Robust Economic Foundation

The economic relationship forms the cornerstone of India-Indonesia ties. Bilateral trade has grown significantly, from $4.33 billion in 2005-06 to $38.84 billion in 2022-23, though it slightly declined to $29.4 billion in 2023-24. Indonesia enjoys a trade surplus, driven by its exports of coal and crude palm oil, with India being the largest buyer of Indonesian palm oil and the second-largest importer of coal.

India’s exports to Indonesia include refined petroleum, commercial vehicles, telecom equipment, pharmaceuticals, and agricultural products. However, coal and palm oil dominate trade, making them critical to future economic engagement.

Barriers to Trade Expansion

Despite the extensive trade relationship, Indian exports face significant non-tariff barriers in Indonesia. Under the ASEAN-India Trade in Goods Agreement (AITIGA), Indonesia presents the toughest market access challenges among ASEAN-6 nations. Indian pharmaceuticals, bovine meat, and agricultural products face stringent phytosanitary standards that restrict exports.

Achieving the ambitious $50 billion trade target requires addressing these barriers and diversifying trade. The AITIGA review must prioritize improved market access for Indian goods and ensure mutual respect in trade policies.

Investment Landscape: Untapped Potential

Indian investment in Indonesia is substantial but often underreported. Official estimates place Indian investment at $1.56 billion, but the actual figure exceeds $10 billion due to indirect flows through Singapore. Key sectors include infrastructure, power equipment, textiles, coal mining, and consumer goods.

Indonesian investments in India remain modest, at around $650 million, focusing on agriculture, processed foods, IT, and logistics. Strengthening ties between Indian and Indonesian CEOs is vital to unlocking the full potential of bilateral investments. Revitalizing platforms like the India-Indonesia CEOs Forum and the Biennial Trade Ministers Forum can provide consistent engagement and direction.

Healthcare, Agriculture, and Strategic Cooperation

Indonesia seeks Indian expertise in public healthcare, food security, and the digital economy. However, significant non-tariff barriers hinder Indian pharmaceutical exports. Addressing these barriers could lower healthcare costs for Indonesians and attract Indian investment. Indian hospitals, such as Apollo and Artemis, are already collaborating with Indonesian counterparts to improve healthcare infrastructure, showcasing the potential for deeper cooperation.

In agriculture, India consistently advocates for better access to the Indonesian market for rice, sugar, and bovine meat. However, Indonesia often restricts these imports, allowing them only during domestic shortages. A consistent import policy would enhance Indonesia’s food security while addressing India’s trade deficit.

Tourism and Defence: Emerging Areas of Collaboration

Tourism has emerged as a strong pillar of the relationship, with Indian tourists frequenting Bali and Jakarta. Direct flights by Indian carriers like Vistara, Air India, and IndiGo have boosted this trend. However, efforts to promote Indonesian tourism in India remain limited.

In defence, Indonesia has expressed interest in acquiring Indian equipment, including the BrahMos missile. Extending rupee-based credit lines for defence exports could align with Indonesia’s budget priorities and deepen bilateral defence ties. Expanding cooperation to include other defence technologies would further enhance the partnership.

A Balanced and Dynamic Partnership

To fully realize the potential of their relationship, India and Indonesia must address challenges such as regulatory barriers, inconsistent market access, and limited engagement between business leaders. Regular forums, enhanced trust, and a focus on emerging sectors like healthcare and the digital economy are critical.

President Prabowo Subianto’s visit offers a unique opportunity for both nations to celebrate their shared history and lay the groundwork for a dynamic partnership that benefits both economies and societies.

Strengthening India-Indonesia ties

Achieving the leaders’ envisioned $50 billion trade target requires diversifying trade and reducing these barriers. The AITIGA review must prioritise improved market access for Indian goods while ensuring mutual respect in trade policies.

Investment Landscape: Untapped Potential

Indian investment in Indonesia is substantial but often underreported. While official Indonesian figures estimate Indian investment at $1.56 billion, much of it flows indirectly through Singapore, a key hub for ASEAN investments. In reality, Indian investments in Indonesia exceed $10 billion, spanning infrastructure, power equipment, textiles, steel, motorcycles, coal mining, banking, and consumer goods.

_202502181218590344_H@@IGHT_355_W@@IDTH_600.jpg)

In contrast, Indonesian investments in India are modest, totalling around $650 million, primarily in agriculture, poultry feed, processed foods, paper products, IT, and logistics. Strengthening business ties between Indian and Indonesian CEOs is essential to unlock the full potential of bilateral investments. The India-Indonesia CEOs Forum, first convened in 2013 and subsequently in 2018, needs to meet regularly and foster consistent engagement, independent of high-level diplomatic visits.

Similarly, the Biennial Trade Ministers Forum, established in 2011, has met sporadically, with sessions in 2017 and 2020. Revitalising such forums, along with Joint Working Groups (JWGs) on coal, renewable energy, agriculture, oil and gas, and the overarching Energy Forum, can provide much-needed direction and government support for trade and investment.

Tourism And Defence: Emerging Areas Of Collaboration

Tourism is another area where Indonesia benefits significantly, with Indian tourists flocking to destinations like Bali and Jakarta. Direct flights by Indian carriers such as Vistara, Air India, and IndiGo have facilitated this surge. However, reciprocal efforts to promote Indonesian tourism to India remain limited.

In defence, Indonesia has expressed interest in acquiring Indian equipment, including the BrahMos missile. Extending rupee-based credit lines for defence exports could support Indonesia’s welfare-driven budget priorities and enhance bilateral defence cooperation. Expanding this partnership beyond missile systems to include other defence technologies would be mutually beneficial.

--