Atmanirbhar Bharat Package-Part 2: Reviving the MSMEs – Reviving the Economy

19 Jun 2020 10:27:31

Second Article in a series of six articles deciphering the “Atmanirbhar Bharat Package” of the Government of India to revive the Indian Economy from the shock of the COVID-19 pandemic and the economic crises thereafter. This article focuses on the steps taken for the revival of the MSME Sector.

The Micro, Small & Medium Enterprise (MSME) sector is an important sector of the Indian Economy. As per the estimates of the Central Statistical Organization (CSO) the MSME sector contributes to about 28.90% of our GDP (2016-17). As per the NSSO’s 73rd round there were 633.88 Lakh MSMEs in India out of which, 51% were rural while 49% Urban. Out of these 630.52 Lakh belonged to the Micro category (more than 99%), 3.31 Lakh to Small and 0.05% to the Medium category. On basis of ownership on gender grounds, 79.63% MSMEs are headed by Male members while 20.37% are female-headed. In 2015-16, the MSME sector created 11.10 Crore jobs. Out of these 32% were in manufacturing, 35% in Trade and 33% in Other Services. Out of the total employment created, 45% was in the rural areas while 55%was in the urban areas. Thus we can see that the role of MSMEs in the Indian Economy is of paramount importance.

It was a rightful step by the Central government to give a priority to the MSME sector in the Atmanirbhar Bharat Package. Let us try to understand what the package has to offer to the MSME sector and what its impact will be.

Direct Measures

1. Firstly the Rs. 3 Lakh Crore Collateral-free Automatic Loans for MSMEs has helped the MSMEs in their critical times to be used as working capital. This amount is intended to be used for meeting operational liabilities, buying raw materials, making outstanding labour payments, etc. This will give a clear boost to the MSMEs to restart their operations in the Unlock Economy phase. This will help almost 45 lakh MSME units.

2. The MSME sector also has lot of ‘Stressed MSMEs’. These are the units which are on the verge of being ‘Non-Performing’. Borrowers with upto Rs. 25 crore outstanding loans & Rs. 100 Crore will be eligible for a four year loan with a moratorium of 12 months on principal repayment. Due to this provision 2 Lakh MSMEs are likely to be benefitted. Using the COVID 19 situation the government has tried to give a big push and a great chance to revive the stressed MSMEs in a single stroke. This is a great example of turning a calamity into an opportunity.

3. Addressing the problem of shortage of Equity faced by the MSMEs, the government is infusing Rs. 50,000 Crore through a special structure of Mother & Daughter Fund. With an input of Rs.10,000 Crore, this fund will be available for viable and potentially strong MSMEs. This will clearly help in expanding their size and capacity thereby generating more employment.

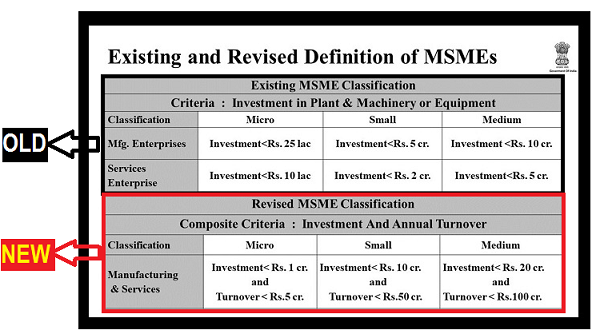

4. The redefining of the MSME definition is a welcome step. It will help to remove the hesitation of the existing MSMEs of graduating out of the benefit bracket. This will boost their surge to grow and create more employment & income. The new definition of MSMEs is as follows:

5. The disallowing of Global Tenders up to Rs. 200 Crore will surely allow a level playing field for Indian MSMEs. It will not only protect them from the many times unfair global competition but will also encourage programs like Make in India, thereby increasing the employment opportunities for Indians.

6. The package has a few flip sides too. Though the e-market linkage is being promoted as a replacement for trade fairs & exhibitions to provide marketing opportunities for the MSMEs, it will destroy the opportunities for the Event Management Sector.

7. The release of receivables from Government & PSUs within 45 days is a welcome step and will help to inject the much needed liquidity in the market.

Indirect Measures

1. Payment of 12% each of the employer’s & employee’s contribution towards EPF has been borne by the government for 6 months ending August 2020. This will reduce the statutory burden on 3.67 MSMEs & 72.22 lakh employees and help in improving their liquidity position.

2. Income tax refunds upto Rs. 5 Lakh released immediately to benefit around 14 lakh taxpayers. It was again aimed at improving the liquidity scenario of the MSMEs.

3. Extension of filing Income tax and GST has released the immediate payment load on the MSMEs and also allowed for maintaining liquidity.

Many such measures, direct or indirect, have helped the MSMEs in multiple ways. With the additional liquidity available the MSMEs could pay the wages & salaries to the workers, pay the suppliers and vendors, buy more raw materials and again give boost to the production process as soon as the lockdown is relaxed. This is a very critical step if we want the economy to surge back quickly in the post COVID 19 regime.

But there are certain challenges that need to be addressed to make this package successful; firstly with large scale reverse migration of labour, most of the MSMEs are now facing an acute labour shortage. Secondly, the lockdown resulted in non-availability of raw material and other inputs, resulting in inflationary pressures on the prices of such goods & services. This is distorting the financial model of many MSMEs, making them non-viable. Thirdly, lack of demand in the market is one of the greatest challenges faced by the MSMEs. Last but not the least, as they say, ‘The proof of the pudding is in eating’, so, the real test of this package lies in its impregnable implementation. With the politics of the opposition parties and the perennial bureaucratic hurdles, the challenge is by no means, easy.