Retributions and penalties! Reserve Bank of India imposes monetary penalty on seven banks

03 Aug 2019 11:28:47

Mumbai, August 03: Imposing in exercise of powers vested in the Central Bank under the provisions of the Banking Regulation Act, 1949, the Reserve Bank of India on Friday penalised Rs 11 crores for seven public sector banks for violating norms on current opening accounts.

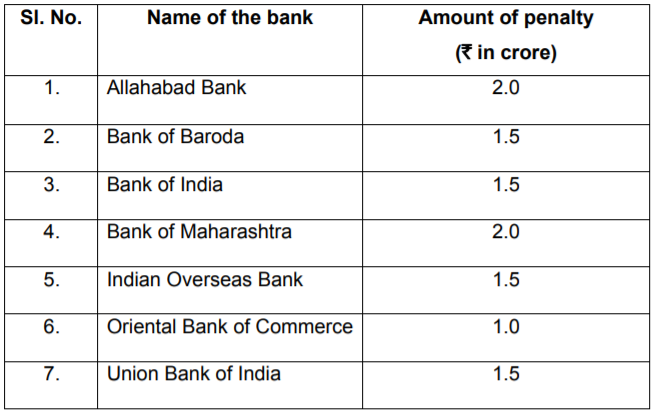

The note released by the bank revealed that the Allahabad Bank and Bank of Maharashtra had been imposed a fine of Rs 2 crore each, Bank of Baroda, Bank of India, Indian Overseas Bank and United Bank of India had been slapped with fines of Rs 1.5 crore each, while Oriental Bank of Commerce had been imposed with a penalty of Rs 1 crore.

"The Reserve Bank of India has, by an order dated July 31, 2019, imposed monetary penalty on seven banks for non-compliance with certain provisions of directions issued by RBI on 'Code of Conduct for Opening and Operating Current Accounts'," RBI said.

"This action is based on the deficiencies in regulatory compliance and is not intended to pronounce upon the validity of any transaction or agreement entered into by the banks with their customers," the regulator added.

RBI carried out a scrutiny of the accounts of companies of a group and observed the banks to fail comply with provisions of one or more of the directions issued by it. Based on the findings of the scrutiny, notices were issued to the banks advising them to show cause as to why penalty should not be imposed for non-compliance with the directions.