Know your Chit Funds! Here's a leaf of new opportunities offering both access to funds and options to save

Total Views | 14

By Siddhi Somani -

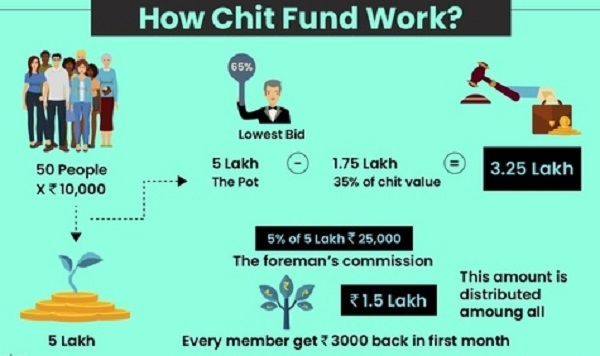

Popular among low-income families, offering both access to funds and options to save, the Chit Funds schemes have reached the roots of the Indian rural economic insfrastructure. Also the need to protect investors interest turns out to be the crucial role, chit funds play while providing people with enhanced investment opportunities.

In the last few years, there have been several alleged frauds pertaining to companies such as Saradha Group, Rose Valley among others as they lured gullible investors to deposit money in their schemes in lieu of abnormally high returns and subsequently shut shop, leaving the rural poor in the lurch.

In some cases, politicians were also alleged to have links with the tainted companies. Since 2016, the Reserve Bank of India has received over 5,200 complaints related to chit fund scams. With this, there emerged the urge to look into the extant Chi Fund Act of year 1982. Aligning to this, a bill to raise the monetary limits for chit funds by three times and the commission for the person managing the fund to 7 per cent from the current 5 was approved by Lok Sabha on Wednesday.

Piloting the bill in the parliament, FinMin necessarily noted that the chit funds are legal and should not be confused with unregulated deposit schemes or ponzi schemes wherein several people have lost their money. Introducing some novel concepts such as 'fraternity fund', 'rotating savings' and 'credit institution' to make the said funds more respectable, the year 2019 amendment in the bill proposed to raise the maximum chit amount from Rs 1 lakh to Rs 3 lakh for those managed by individuals or less than four partners, and from Rs 6 lakh to Rs 18 lakh for firms with four or more partners.

While the bill has already incorporated suggestions from a parliamentary standing committee, which had examined an earlier version of the draft, which had lapsed days after the national polls, the newly proposed changes in the bill include raising the maximum commission of the person who manages the fund from 5% to 7% of the chit amount. The bill now also allows the foreman a right to lien against the credit balance from subscribers.

"Further it proposes to substitute terms like chit amount, dividend and prize amount with gross chit amount, share of discount and net chit fund respectively. It would also allow subscribers to join the process of drawing chits through video-conferencing", Anurah Thakur said in the Parliament adding that the bill also removed the limit of Rs 100, allowing the state governments to specify the base amount over which the provisions of the Act would apply.

Responding to various issues raised by members during the debate, Thakur said that the chit fund subscribers could opt for insurance, barring the government to make it mandatory as it would add to their burden. On compensating poor people from money collected under the GST, he cleared that it was something which can only be considered by the GST Council.

India is to become a USD 5 trillion economy by 2024. Such undertakings by the NDA led governmnet with regard to economy and financial inclusion can be considered as wonderent. Participating in the debate, several BJP members also lauded the government's this move, adding that it would help protect the money of the economically weaker section.

Although various questions in this reference were raised up in the House, the panel gave its recommendations in August 2018 and the process took more than a year for the government to bring the fresh bill with amendments, justifying its distance downwards.

Investing in chit funds is many a times considered a bare activity, because when banking system give an interest rate of nearly 8-9 per cent, then how can one provide an interest of nearly 30 to 40 per cent. There are over 30,000 registered chit funds in the country and the unregularised would be more than 100 times the number. With this the NDA-led government seems to have initiated to shelter more people in the formal sector.