Petrol prices graphing emphatically in NDA’s directive amidst the international price trends

Total Views |

Pune, January 4: The very economical aspect directly affecting the end consumer in the nation can be nothing but the crude oil prices as directly linked to them. The issue of rising prices of petroleum products is a burning topic in an energy-guzzling country like India. With each passing year, oil seems to play an even greater role in the global economy as well.

In the early days, finding oil during a drill was considered somewhat nonsensical as the intended treasures were normally water or salt. With oil's stature as a high-demand global commodity comes the possibility that major fluctuations in price can have a significant economic impact.

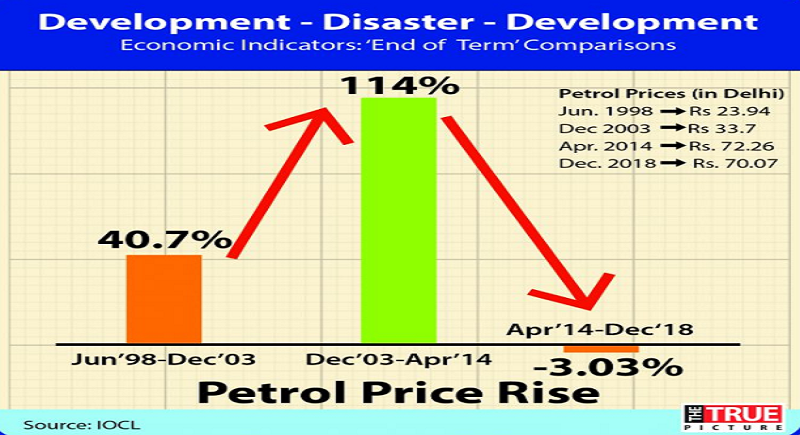

Recently, the present government was attacked for the rise in prices of petroleum products by Congress Party. However, facts tell a different story. As shown in the graph below, if one compares the retail prices of petrol in Delhi at different time periods, then the highest growth in petrol prices happened during UPA governments. Petrol prices rose by 114% between 2003 and 2014. Under the Modi government, Petrol Prices have in fact declined by 3% as shown in the graph below.

Though there is a mix of both private sector companies like Reliance Industries, Cairn India Ltd; and public sector counterparts like Oil India, Oil and Natural Gas Corporation (ONGC) among others in this sector. However, these companies together cater to only 25% of India’s crude oil requirement. 75% of India’s crude oil needs is met through imports. International prices of crude oil and foreign exchange rates form the base components of price of petrol and diesel prices in India.

Earlier these prices were changed fortnightly based on the average price of crude oil and foreign exchange rate of the preceding 15 days. But from the beginning 16th June last year, all petrol pumps across the country have been changing their petrol and diesel prices each day based on market prices of crude oil (International )and foreign exchange rates.

The old pricing systems have failed to change proportionally with the rise and fall in international crude oil prices due to political intervention. So in order to find the need for shifting to daily fuel price change model, one has to understand the dynamics of petrol pricing in India.

Unlike most products and indicators, oil prices are not determined entirely by supply, demand and market sentiment toward the physical product. Rather they play a dominant role in price determination. Regardless of how the price is ultimately determined, based on it’s use in fuels and countless consumer goods, it appears that oil will continue to be in high demand for the foreseeable future.