Lies, Damn Lies or Nescience – Exit Polls & Stock Market Scam!

Total Views | 1182

Why is the Opposition building the narrative of the stock market manipulation and falsification of Exit Polls?

Why and What happened post-1st June 2024, when the elections got over?

Why did the markets get jitters on 4th June, when the election results came?

The Verse:

"मदमूढबुद्धिषु विवेकिता कुतः”

Meaning: Where is the right thinking, reasoning and rationality in people, whose intellect is fooled, blinded or dumbed by their pride and privilege?

This 5000-year-old Sanatan verse summarizes what’s happening in the present world.

The Past, the History, the Context

Bharat got its independence in 1947, but the rate of growth and development was rather slow through the years. Wars and hostility with neighbours, corruption, and nepotistic politics only made it worse.

In 1991, under severe compulsion, and under the leadership of a strong Prime Minister Shri Narasimha Rao Ji, LPG (Liberalisation, Privatisation and Globalisation) reforms were undertaken, when Bharat’s forex reserves dipped below 1 billion USD in Jan 1991, and Govt of Bharat had to pawn its gold to raise money and Prime Minister’s own party Member of Parliament went on a rampage against their own leader.

Bharat was on the verge of bankruptcy, whilst 55 members of Parliament including 7 ministers of the ruling Party (Grand Old Party) were opposing their leader against opening up the economy and conducting reforms.

Sensex (Nifty will start in 1994, with NSE to be established in 1992) then lingered around 1000, before moving up to 4000 in a year's time, before slipping back again below 4000 levels on account of Harshad Mehta Scam.

The Reforms, laying the fundamental foundation and the Growth of Equities

The journey of the Sensex from 1000 or so to 74, 468 on 3rd June 2024 has not been linear and has seen severe ups and downs and serious volatility, sometimes steep and sometimes harsh on account of global and domestic factors both.

As the economy came on the fast track, post reforms in 1991, the coterie or corridors started seeking their flesh of pound in a decade, predominantly during the regime run between 2004 and 2014. During this short decade, Bharat saw a series and slew of corruption and that too of a scale that was unheard of.

In 2014, the People of Bharat voted for change and gave a decisive mandate to Mr Narendra Damodardas Modi to improve things and systems at the grassroots level. Modi's team respected the mandate and got on to work harder day and night.

From Jan Dhan to demonetization to GST to digitization to DBT, to Make in India, to innumerable policies benefitting the last man standing, Mr Modi and his able team laid the foundation of a New, rapidly growing, swift action-oriented Bharat. 5 years went in a jiffy.

In 2019, the people of Bharat gave a thumping mandate bigger than before with the Ruling party winning 303 against 282 won in 2014 and 272 needed to have an absolute majority in the Lower Houe of Parliament.

With the second term’s achievements of the government, despite COVID-19, Bharat saw a serious thrust on infrastructure creation with most modern bridges, roads, and railway engines, to developing the lightest fighter plane in the world. PLI Scheme gave a big Filip to Make in India and when the entire world was engulfed in the chaos of the Russian-Ukraine War with food shortages, energy shortages, and arms and ammunition shortages, Bharat and Bharat’s economy was firing on all cylinders, emerging as the fastest-growing major economy in the World.

Seeking the Mandate - 400 Par

Backed by work, supported by Saabka Saath, and Saabka Vikas and bringing Bharat back on the Map of the World to be seen as a power too big to ignore and a power to reckon with, the incumbent government went and campaigned hard seeking a bigger third mandate to ensure that the momentum that has been built continues and the juggernaut of Bharat persists to bewilder the World.

The Elections got over on 1st June 2024 with no untoward incidents and with 642 million voters exercising their Universal suffrage, creating a world record.

The Hope, the Dream, The Exit Polls

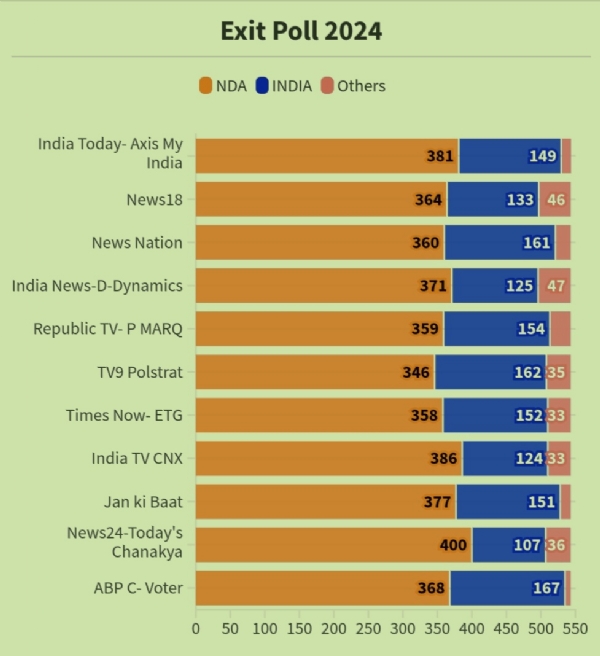

On the evening of 1st June 2024, 11 Exit Polls across all news channels predicted 350 + NDA as well as ensuring that BJP on a standalone basis will cross the mark of absolute majority with over 272 seats in the Lower House of Parliament.

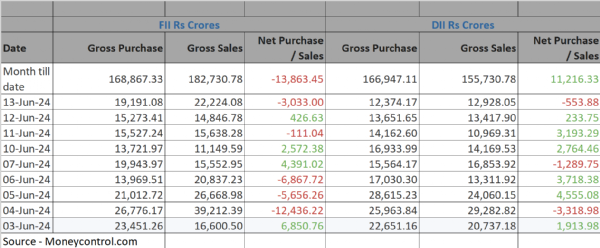

Markets that act on anticipation were jubilant and both Indices Nifty and Sensex touched a record high. Markets were sure that continuity of policies and stability of government would take Bharat to new heights both financially as well as geo-politically. Thus the enthusiasm from market participants, anticipating, that if Exit Polls do become a reality, they may miss the bus of participation in Bharat’s growth story. Anticipating another landslide victory for BJP and NDA as was seen in Term 2, both FIIs (Foreign Institutional Investors) and DIIs (Domestic Institutional Investors) executed the net purchase of Bharat’s equities.

The Election Outcome

The very next day,i.e. on 4th June 2024, as BJP – the leading party in the incumbent government failed to get an absolute majority by itself, and the market started getting jitters with the perspective, what if Mr Modi or BJP is not able to form the government.

What if a fractured INDI Alliance forms the government by tempting alliance partners of NDA to break away from the government?

Furthermore, apprehensions started seeping into investors's minds, that Mr Modi has never run a coalition in the past, since 2002 when he became the chief Minister of Gujarat.

In addition to this, whether he was the chief minister or Prime Minister, the BJP had an absolute majority to run the government and implement reforms quickly and take the region, state or country on a fast-track growth Path.

Will Mr Modi be able to navigate the coalition and yet manage to implement policies and his vision of Viksit, a manufacturing-oriented, inclusive Digital Bharat?

Markets also perceived that the track record of the BJP especially in big states where they don’t have an absolute majority in the State Assembly has not been great in terms of policy execution and making decisive changes for the progress of the State.

The Mega Sell-Off

Markets reacted to the uncertainty of Bharat’s future and their investments in Bharat.

Under Panic, the reaction was obvious, Press the Sell Button, especially on PSUs that have been turned around, made profitable and become leaders in their own segments trumping the hegemony of Private players as well as global firms, that were earlier given red carpet welcome to use Bharat only as a market and reap unholy profits by exploiting the essentials needed by Bharat.

The result of high expectations from the incumbent government and no absolute majority by the BJP made the market Peak hit the turf. Sensex tumbled intraday 6200 points and finally settled with 4390 or 5.74%. Similar was the case with Nifty and Bank Nifty, which plunged by 5.93% and 7.4% respectively.

PSUs were hit, most with a BSE PSU Index losing over 15.68% in a single day, with most individual PSU stocks wiping 10% - 25% of their market capitalisation. For quite a few stocks, there was a temporary freeze as PSUs hit the lower circuit.

Investors lost ~ 31 Lakh Crores of Networth on a Single day.

The nescience of Opposition

Now decipher the point of Opposition.

1. Why did Exit Polls completely miss out on the Verdict that came on 4th June 2024?

2. Can the Stock market be manipulated?

3. Why did PM and HM speak of people investing in stock markets?

Delving Deeper in all the Questions

1. Why did Exit Polls miss out on the Verdict on the 4th?

Starting with Basics, Exit Polls are the interviews and surveys conducted by various research agencies from the pollsters immediately after they cast their votes and leave the polling booths.

The idea of an immediate survey is the shorter the time frame between the polling and the survey, the lesser the chances of change in response or change in mind by the pollster while answering the questions.

Various steps that are involved in Exit Polls include -

1. Sampling

2. Line of Questioning predominantly focused on whom one has voted for and why.

3. Data Collection

4. Analysing the Data and Making Predictions

Challenges with the Exit Polls

1. Sample Size and Quality of Sample Size - Some believe that the larger the sample size, the more accurate the data. However, the data can be biased sometimes, or there can be errors in the response from the respondent. Furthermore, the prediction is based on the vote share and that vote share is then translated into the candidate winning the seat.

2. Logistical challenge – Since the competition in Exit Polls is getting tougher and faster, it’s impossible to get a response from each village or Taluka or sub-district and that itself can play a major swing in candidates winning or losing.

3. Errors in Weightages – The results can be erroneous due to wrong or misaligned weights to the demographics or having specific biases.

This is one of the reasons why despite having 11 Exit Polls, no two polls have their numbers matched.

There have been times in the past when Exit Polls have gone grossly wrong the way, it happened in 2024.

UP Election 2017

Most exit polls in the 2017, UP State Elections showed that BJP will maximum win 200 seats in a State Assembly of 403, whilst some predicted a low number of 170 or so for BJP. However, the BJP won with a landslide with 325 Seats.

Bihar 2020 Elections

In 2020, in the State Assembly Elections, Exit Polls predicted, 137 seats for Mahagathbandhan (MGB) led by RJD – Lalu Yadav and NDA to win 97 seats in a 243 Assembly seat contest. The highest number during Exit Poll Predictions for MGB was 180 and the lowest number predicted by Exit Polls was 120, thereby MGB forming the government.

However, the Outcome was absolutely the opposite, with NDA taking the Majority and MGB being ousted with a mere 94 seats.

Lok Sabha Elections 2004

The Exit Polls for the Vajpayee government predicted that BJP would win 240 seats in the 2004 elections and would continue the government and reforms, however, BJP could only score 187 seats and Congress and their allies UPA managed to score 216 and thereby forming the government.

Exit Polls thus give an indication and can’t be fully relied upon. Despite of errors and inaccuracies, Exit Polls remain relevant, as they provide a heads-up to the World and to the political parties to start thinking of their future with a new open perspective.

2. Can the Stock market be manipulated?

Both NSE and BSE have been running for over 3 decades and a century or more respectively and have seen several governments being formed as well as being removed through elections, as well as through no-confidence motion. Both NSE and BSE are independent platforms and just reflect the sentiments and the current future perspective of its participants. It’s a dynamic platform that incorporates all pieces of news and reacts and behaves as per its market participants.

NSE, the newest Stock Exchange, is the world’s largest derivatives exchange group in 2023 by the number of contracts traded, according to the Futures Industry Association (FIA), and is ranked third in the equity segment in the world amongst all exchanges.

In Bharat, there are over 15.4 Crore demat accounts and the assumption is that every investor having a demat account is also executing trades in Equity Markets. Further, there are 4.5 Crore mutual fund investors in India and a large part invest in Equities.

The numbers have been growing and more people are moving away from physical assets to financial assets. This shift has been significant since 2014 when the economy was put on the fast track of development, sustainability as well as combined prosperity.

On 4th June 2024, as the day progressed and as NDA seemed to be on strong footing, markets recovered from the lows and the next day markets and indices started roaring back.

As one speaks today, post-PM Modi taking the oath of Office for the third time, both indices Nifty and Sensex have crossed the previous highs made on the 3rd of June surpassing the all-time high record made on the 3rd and enhancing global and domestic investors' confidence and wealth on and in Bharat.

3. Why did PM and HM speak of people investing in stock markets?

Both the PM (Prime Minister) and the HM (Home Minister) wish well for Bharat and for the People of Bharat. They both have always taken the approach of Pratham Bharat, and Shrestha Bharat always.

In context to that, both PM and HM during interviews mentioned and called the people of Bharat to invest in Equities, because this is the simplest way for the common man, for the poorest soul in Bharat, for the last man standing to participate and win in the Growth and Prosperity of Bharat.

Why should only the rich who have the expertise and expert advisors be winning from Bharat’s progress and Prowess? Thus PM and HM suggested the people of Bharat should invest in Equities not for a day, not for a month but for a decade, as they and we all believe that this is not only the decade but the century of Bharat.

In fact, the Opposition senior members have large exposure to Bharat’s and PSU equities, which have made a mega comeback during the Modi Era of the last 10 years.

Unfortunately, 250 years of Slavery by Britishers and years of Nepotistic Politics have broken and shaken the confidence of the common man in himself.

Hence they get easily confused by freebies, falsified Truth and Factual Misrepresentation.

Thus Siddhartha Rastogi says, “Be cautious, of what you are consuming in terms of food, words, and media as the Opposition knows how to manage and manipulate the masses well. They know that every time if they cannot convince them, they just confuse them”.

Bharati Web