US Invests $553 Million In Adani Port In Sri Lanka To Curb China’s Influence

Total Views | 166

As New Delhi and Washington seek to limit China's influence in South Asia, the US will offer $553 million in finance for a port facility in Sri Lanka's capital being planned by billionaire Gautam Adani.

The International Development Finance Corporation investment highlights ongoing US and Indian attempts to weaken Beijing's grip on Sri Lanka, which borrowed extensively to lavish on Chinese port and highway projects before the country's economic catastrophe last year.

After claims of fraud by short seller Hindenburg Research destroyed billions from the conglomerate's market value early this year, Mr Adani may see US money as a stamp of respectability.

The deepwater West Container Terminal in Colombo is the US government agency's largest infrastructure project in Asia and one of the largest in the world.

It would boost Sri Lanka's economic growth and "regional economic integration, including with India, a key partner for both countries," according to the DFC.

The money is part of a global acceleration of DFC investments, which are expected to total $9.3 billion by 2023. According to a US official, the port finance in Sri Lanka exemplifies the US desire to become increasingly involved in development projects throughout the Indo-Pacific.

As of the end of last year, China was the island nation's largest foreign direct investor, having invested over $2.2 billion. Officials from the United States have openly denounced Sri Lanka's little-used southern Hambantota port as unsustainable and part of China's "debt-trap diplomacy."

The money is part of a global acceleration of DFC investments, which are expected to total $9.3 billion by 2023. According to a US official, the port finance in Sri Lanka exemplifies the US desire to become increasingly involved in development projects throughout the Indo-Pacific.

As of the end of last year, China was the island nation's largest foreign direct investor, having invested over $2.2 billion. Officials from the United States have openly denounced Sri Lanka's little-used southern Hambantota port as unsustainable and part of China's "debt-trap diplomacy."

DFC stated that it will collaborate with sponsors John Keells Holdings Plc and Adani Ports & Special Economic Zone Ltd., depending on their "local experience and high-quality standards."

Because of its closeness to international shipping lines, Colombo's port is one of the busiest in the Indian Ocean. Its seas are home to over half of all cargo ships. The DFC stated that it has been running at more than 90% utilization for two years and requires additional capacity.

The US money may act as an endorsement for the Adani Group, which has been hammered by short sellers, as well as the contentious port project in which it has a controlling interest. The corporation has been facing a slew of corporate fraud claims filed by Hindenburg Research and different media investigations, which it has constantly rejected.

Because of its closeness to international shipping lines, Colombo's port is one of the busiest in the Indian Ocean. Its seas are home to over half of all cargo ships. The DFC stated that it has been running at more than 90% utilization for two years and requires additional capacity.

The US money may act as an endorsement for the Adani Group, which has been hammered by short sellers, as well as the contentious port project in which it has a controlling interest. The corporation has been facing a slew of corporate fraud claims filed by Hindenburg Research and different media investigations, which it has constantly rejected.

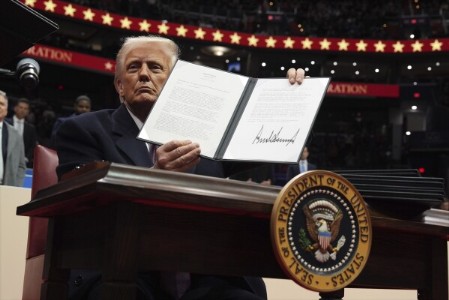

The Trump administration formed the Development Finance Corporation (DFC) to help developing countries while furthering US foreign policy aims. Due of the Covid-19 outbreak, it first struggled to get projects all over the world.

According to a new research from the AidData center at William & Mary in Virginia, financing has surged in recent years, and the agency has helped Washington bridge the development expenditure gap with China's far more visible Belt and Road Initiative.

The DFC's support will result in "greater prosperity for Sri Lanka - without adding to sovereign debt - while also strengthening the position of our allies across the region," according to Scott Nathan, chief executive officer of the DFC.

According to a new research from the AidData center at William & Mary in Virginia, financing has surged in recent years, and the agency has helped Washington bridge the development expenditure gap with China's far more visible Belt and Road Initiative.

The DFC's support will result in "greater prosperity for Sri Lanka - without adding to sovereign debt - while also strengthening the position of our allies across the region," according to Scott Nathan, chief executive officer of the DFC.

Bharati Web